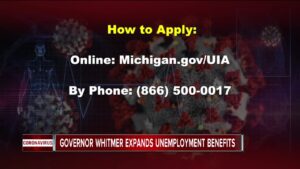

Unemployment benefits are a vital resource for workers facing job loss. In Michigan, the standard period for unemployment benefits is generally set at around 20…

Unemployment benefits provide essential financial support to workers who have lost their jobs.

Starting a business is a considerable feat, and ensuring you’re legally set up is an essential initial step.

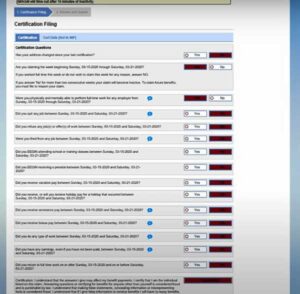

So you’ve completed your application for jobless benefits and have submitted it to the unemployment insurance agency.

If you operate a business in Michigan and are considered an employer, you are legally obligated to pay unemployment taxes.

Filing an additional claim is necessary in certain circumstances.

The Michigan Work Share program provides an innovative option for Michigan employers facing potential layoffs due to a decline in business.

Navigating the unemployment benefits process can be a challenging task, especially when circumstances change and you find yourself needing to reopen a claim.

Understanding how to certify for unemployment benefits can prove to be an invaluable resource during challenging economic circumstances.

The legal system can be difficult to navigate and often expensive.