Many low- to moderate-income employees may be qualified for the Earned Income Tax Credit, or EITC.

You must fulfill certain basic standards to qualify for the credit, but if you do, it might result in a larger return.

Amount of Credit

The amount of credit you are eligible for is determined by your household income and size. Families with at least one qualified kid may get a tax return worth thousands of dollars. The EITC may be available to employees who may not have a qualifying kid.

The most essential thing to remember when claiming the credit on your tax return is to get everything properly. Even little mistakes might create problems. Make sure, for example, that you record your income accurately and that any kid you claim fulfills all of the eligibility requirements.

Using IRS free file software to file electronically is a terrific method to ensure that your return is correct, since the program asks you questions and guides you through the filing process, as well as does all of the arithmetic for you. You may also obtain free tax preparation assistance at a volunteer location near you.

If you hire a tax preparer, choose someone you can trust to submit an accurate return. In mid-February, the IRS starts issuing any refunds claiming the EITC or the increased child tax credit.

Here are some resources to help you learn more.

To determine whether you qualify for the tax credit, go to irs.gov/eitc; irs.gov/freefile provides links to Free File software alternatives; and irs.gov/vita contains locator tools to help you locate a location near you where volunteers will do your taxes for free. Finally, go to irs.gov/chooseataxpro for advice on selecting a tax preparer.

The EITC (Earned Income Tax Credit) may be able to assist you in saving money

The Earned Income Tax Credit (EITC) provides a tax benefit to employees and families that do not earn a lot of money. If you qualify, you may utilize the credit to lower your tax bill and perhaps even get a larger return.

For qualifying working families, the credit is usually greater… However, many low-wage employees without children may be eligible for a reduced credit. Because the EITC is now accessible to qualified employees aged 19 to 64 who do not have qualifying children, this is the case.

There are also unique exclusions for persons under the age of 18 who were previously in foster care or are destitute. If you work with a tax preparer, have them look into the credit for you. If you prepare your own taxes, we suggest filing them online.

That’s because the e-file program will ask you the appropriate questions to ensure that you get the compensation you deserve.

In any case, don’t let money slip through your fingers. Check to determine whether you qualify for the Earned Income Tax Credit if you have a low to moderate income. Go to IRS.gov/EITC to see whether you qualify.

To Qualify

Did you realize that the Earned Income Tax Credit may boost your federal tax return by $6,700? If you worked last year and had a low-to-moderate income, you may be eligible for the Earned Income Tax Credit when filing your taxes. If you have children, the earned income tax credit, or EITC, might be worth thousands of dollars.

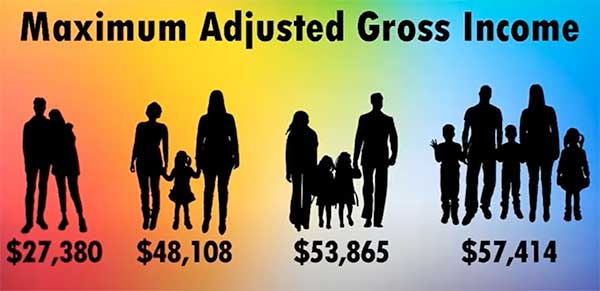

Even if you don’t have children, you may obtain a part of the credit. Here’s a short breakdown of the maximum adjusted gross earnings for married couples without children, as well as those with one, two, or three children.

If you’re married and earn less than this, you’re most likely eligible.

For single taxpayers, the maximum income levels are lower.

You must have a valid Social Security number to be eligible. All year, you must be a US citizen or a resident immigrant. Your earnings must stay inside specific parameters. (Keep in mind that unemployment payments are not considered earned income and hence are not eligible for the EITC.) However, they constitute taxable income, which may have an impact on the amount of EITC a person receives.)

Visit irs.gov/eitc for additional information on the credit, including if you qualify.