A Complete Guide to Requesting Forgiveness of Your Alabama Unemployment Overpayment Debt—Eligibility Rules, Waiver Questionnaire Process, Required Documents, and What to Do If Denied

✓ Informational Purposes Only

This guide provides general information about Alabama unemployment overpayment waivers and does not constitute legal advice. Overpayment rules, waiver eligibility, and procedures can be complex and vary by individual circumstance. Always verify current information with the Alabama Department of Labor (ADOL) or consult a qualified legal professional for advice specific to your case.

⚡ Quick Answer

An overpayment waiver in Alabama means you’re asking the Alabama Department of Labor to forgive (waive) your unemployment debt if the overpayment was not your fault and repaying it would be unjust or cause financial hardship. Alabama requires all waiver requests to be made in writing by completing a waiver questionnaire. Important: Waivers are generally not available for overpayments caused by fraud or appeal reversals. If you disagree with the overpayment itself, you should file an appeal instead (or in addition to requesting a waiver).

📌 Key Takeaways

- Waiver ≠ Appeal ≠ Payment Plan: A waiver requests forgiveness of debt; an appeal disputes the overpayment determination; a payment plan lets you repay in installments.

- Don’t miss the appeal deadline: In Alabama, an appeal must be filed within 15 calendar days of the mailing date of the notice or within 7 calendar days if the notice was delivered in person. If you disagree with the determination, file before it becomes final.

- Waiver must be in writing: Alabama requires completion of a waiver questionnaire. There is no universal PDF form publicly available; you must request the questionnaire from ADOL.

- Fraud overpayments: Waivers usually not available. Overpayments resulting from fraud or appeal reversals are generally not eligible for waiver under Alabama rules.

- Keep certifying if you appeal: If you file an appeal and are still unemployed, continue filing your weekly certifications to preserve potential benefits.

⏱️ Do This First (60 Seconds)

Before you read the full guide, take one minute to gather critical information:

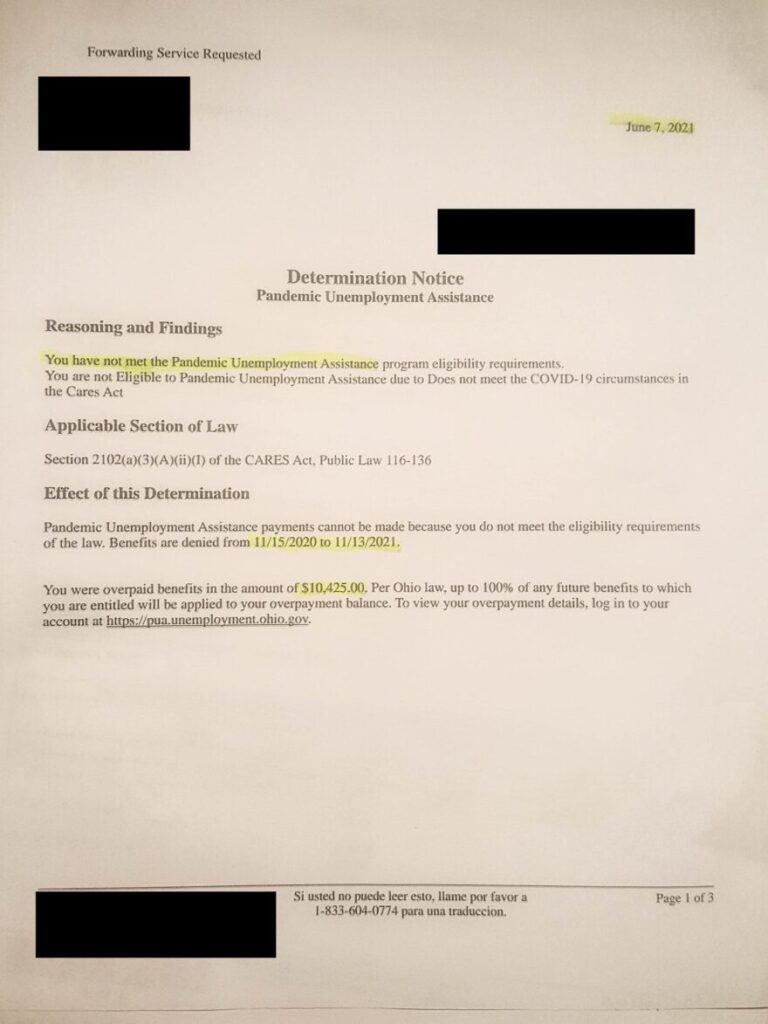

- Find your “Notice of Determination” or “Notice of Overpayment” letter from ADOL (check mail, email, or your claimant portal).

- Identify key details: Reason for overpayment, weeks affected, total amount owed, whether it’s labeled “fraud” or “non-fraud,” and the appeal deadline.

- Decide your next step:

- If the overpayment is wrong (you disagree with it) → File an appeal immediately.

- If the overpayment is correct but you can’t afford to repay → Request a waiver or explore a payment plan.

- If both apply → You can appeal and request a waiver (though waiver reviews typically happen after appeals are resolved).

📑 Table of Contents

- What an “Overpayment Waiver” Means in Alabama (ADOL)

- Read Your Determination Letter (Reason + Weeks + Deadlines)

- Who Qualifies for an Alabama Overpayment Waiver?

- How to Request an Alabama Overpayment Waiver (Step-by-Step)

- Alabama Waiver “Form”: Is There a Single Form?

- Documents Checklist (What to Submit)

- What Happens After You Apply? (Timeline + Decision)

- If Your Waiver Is Denied: Can You Appeal the Denial?

- Repayment Options (If Pending or Denied)

- Special Cases (Alabama)

- Frequently Asked Questions (FAQ)

- Official Resources (Sources + Next Steps)

1. What an “Overpayment Waiver” Means in Alabama (ADOL)

If you received Alabama unemployment benefits and the Alabama Department of Labor (ADOL) later determined that you were overpaid, you will typically receive a Notice of Determination or Notice of Overpayment explaining the reason for the overpayment, the weeks affected, and the total amount you owe. An overpayment means you received unemployment benefits you were not entitled to, whether due to an error, a change in circumstances, or another reason.

A waiver is a formal request asking ADOL to forgive (waive) the requirement to repay some or all of the overpayment debt. Essentially, you’re asking the state to not collect the money from you because the overpayment was not your fault and repaying it would be unjust or cause financial hardship.

Waiver vs. Appeal vs. Repayment Plan

It’s critical to understand the difference between three common options for dealing with an overpayment:

- Appeal: You disagree with the overpayment determination. You believe the overpayment is incorrect (e.g., wrong weeks, wrong reason, or you were actually eligible for those benefits). Filing an appeal triggers a formal hearing process where you can present evidence to contest the overpayment. Appeal deadlines in Alabama are strict—file within 15 calendar days of the mailing date of the notice, or within 7 calendar days if delivered in person.

- Waiver: You agree the overpayment is correct (or the overpayment determination is final), but you’re asking ADOL to forgive the debt because it wasn’t your fault and you cannot afford to repay it. A waiver does not dispute the overpayment; it requests relief from repaying it.

- Repayment Plan: You acknowledge the overpayment and intend to repay it, but you cannot afford to pay the full amount at once. You contact ADOL’s Benefit Payment Control unit to arrange a monthly installment plan. A payment plan does not eliminate the debt—it simply spreads repayment over time.

Important: You can file an appeal and request a waiver. However, waiver reviews typically occur after all appeal rights have been exhausted or become final. In other words, if you believe the overpayment is wrong, appeal first. If the appeal is denied and the overpayment becomes final, you can then request a waiver.

2. Read Your Determination Letter (Reason + Weeks + Deadlines)

Your overpayment notice contains critical information you need to understand your options. When you receive a Notice of Determination or Notice of Overpayment, carefully review the following details:

- Reason for the overpayment: Why did ADOL determine you were overpaid? Common reasons include returning to work and not reporting earnings, being disqualified after an eligibility issue was reviewed, benefit year errors, or agency mistakes.

- Weeks affected: Which specific weeks were overpaid?

- Total amount owed: How much must you repay?

- Fraud vs. non-fraud designation: Is the overpayment classified as fraud or non-fraud? This is crucial—fraud overpayments typically carry additional penalties and are usually not eligible for waiver.

- Appeal deadline: In Alabama, an appeal must be filed within 15 calendar days of the mailing date of the notice or within 7 calendar days if delivered in person. Do not miss this deadline if you disagree with the overpayment.

Identify Non-Fraud vs. Fraud (Why It Matters)

Alabama law and administrative rules distinguish between fraud and non-fraud overpayments. This distinction significantly impacts your options:

- Non-Fraud Overpayment: The overpayment occurred due to an honest mistake, agency error, or change in circumstances—but without willful intent to defraud. Non-fraud overpayments are eligible for waiver consideration (if you meet the criteria).

- Fraud Overpayment: ADOL determined that you willfully misrepresented information or failed to disclose material facts with intent to obtain benefits improperly (e.g., working and claiming benefits without reporting earnings). Fraud overpayments typically carry monetary penalties, disqualification from future benefits, and possible criminal prosecution. Waivers are generally not available for fraud overpayments under Alabama rules.

According to ADOL’s Miscellaneous Information FAQ, “Overpayments determined to result from fraudulent intent or appeal reversals will not be waived.”

Appeal Basics in Alabama (What You Need)

If you believe the overpayment is incorrect, you have the right to appeal. To file an appeal in Alabama:

- Locate the Document ID: The Document ID is located in the top right-hand corner of your Notice of Determination letter. You need this ID to file an online appeal.

- File within the deadline: Appeals must be filed within 15 calendar days of the mailing date of the notice or within 7 calendar days if delivered in person. Missing this deadline can cause the determination to become final.

- Submit your appeal: You can file online at the ADOL Hearings and Appeals page, or by mail or fax if online filing is not available.

- Prepare for your hearing: If you appeal, you will be scheduled for an appeal hearing (usually by phone). Gather evidence, documents, and witness statements to support your case.

⚠️ Warning: Do Not Miss the Appeal Deadline

Alabama’s appeal deadlines are strict. If you do not appeal within 15 calendar days of the mailing date of the notice (or or within 7 calendar days if delivered in person), the determination can become final. If you’re unsure whether to appeal, filing on time helps preserve your rights while you gather information.

For a complete guide to the Alabama unemployment appeal process, see our dedicated Unemployment Appeal Guide.

3. Who Qualifies for an Alabama Overpayment Waiver?

Not everyone who owes an unemployment overpayment will qualify for a waiver. Alabama’s waiver process is governed by Alabama Administrative Code Rule 480-4-4-.07, which gives the Secretary of Labor (or designee) discretion to waive repayment under specific circumstances.

Core Standard: No Fault + Fairness/Hardship

To qualify for a waiver in Alabama, you typically must demonstrate both of the following:

- The overpayment was not your fault: You did not willfully misrepresent information, fail to disclose material facts, or intentionally cause the overpayment. Examples include agency errors, employer reporting mistakes, or honest misunderstandings of eligibility rules.

- Repayment would be against equity and good conscience or cause financial hardship: Requiring you to repay the overpayment would be unfair given the circumstances, or you genuinely cannot afford to repay the debt without suffering significant financial hardship (e.g., inability to pay for basic necessities like housing, food, medical care).

The waiver decision is discretionary—meaning ADOL has the authority to approve or deny your request based on a review of all facts and circumstances. There is no automatic right to a waiver, even if you meet the basic criteria.

When Waivers Are Usually NOT Available

Alabama law and policy generally exclude certain types of overpayments from waiver consideration:

- Fraud overpayments: If ADOL determined the overpayment resulted from fraudulent intent (willful misrepresentation or failure to disclose), the overpayment is not eligible for waiver.

- Appeal reversals: If you received benefits, appealed a disqualification, and the appeal decision reversed your eligibility (resulting in an overpayment), waivers are generally not granted.

- Unreported earnings: If you failed to report wages while claiming benefits, this may be treated as fraud (depending on intent) or at minimum may weigh against waiver approval.

- Claimant fault or negligence: If the overpayment occurred because you failed to follow instructions, did not read notices, or otherwise caused the error through your own negligence, waiver is less likely to be approved.

According to ADOL’s official FAQ, “Overpayments determined to result from fraudulent intent or appeal reversals will not be waived.”

✓ You May Qualify for a Waiver If:

- The overpayment was caused by an agency error or employer reporting mistake.

- You honestly believed you were eligible and followed all instructions to the best of your understanding.

- The overpayment is classified as non-fraud.

- You have limited income and assets and cannot afford to repay the debt without hardship (e.g., unable to pay rent, utilities, food, or medical expenses).

- All appeal rights have been exhausted or the overpayment determination is final.

- You can provide documentation proving your financial hardship (income, expenses, dependents, etc.).

4. How to Request an Alabama Overpayment Waiver (Step-by-Step)

If you believe you qualify for a waiver, follow these steps to submit your waiver request to ADOL:

Step 1: Find Your Overpayment Notice + Gather Details

Before you can request a waiver, you need to understand your overpayment. Locate your Notice of Determination or Notice of Overpayment and note:

- The reason for the overpayment

- The weeks affected

- The total amount owed

- Whether the overpayment is classified as fraud or non-fraud

- The appeal deadline (to ensure you don’t miss it if you also plan to appeal)

Step 2: Request the Waiver Questionnaire

According to ADOL’s official guidance, “All requests for waiver of repayment of the overpayment must be made in writing by completing a waiver questionnaire and returning the completed questionnaire to the department for review.”

To obtain the waiver questionnaire, contact ADOL via:

- Email: UCOverpayments@labor.alabama.gov

- Phone: (334) 956-4000 or Benefit Payment Control at 1-800-392-8019 (8:00 a.m. – 5:00 p.m. CST, Monday–Friday)

- Mail: Alabama Department of Labor, Attention: Benefit Payment Control, 649 Monroe Street, Room 3430, Montgomery, AL 36131-4200

Explain that you would like to request a waiver of your unemployment overpayment and ask them to send you the waiver questionnaire. Be prepared to provide your Social Security Number, claimant ID, and the overpayment notice details.

Important: Alabama’s Benefit Rights and Responsibilities handbook notes that “Requests for waiver questionnaires are reviewed by the Waiver Committee only after all appeal rights on your overpayment(s) have become final.” This means if you also plan to appeal, you should file your appeal first; the waiver request will be considered only after the appeal process is complete.

Step 3: Complete the Questionnaire + Attach Hardship Evidence

Once you receive the waiver questionnaire, fill it out completely and accurately. The questionnaire will ask about:

- Your current employment status and income

- Your household size and dependents

- Your monthly expenses (rent/mortgage, utilities, food, medical, childcare, transportation, etc.)

- Your assets (bank accounts, property, vehicles)

- Why you believe the overpayment was not your fault

- Why repaying the overpayment would cause financial hardship

Attach supporting documentation to prove your financial situation. See Section 6 below for a detailed documents checklist.

Step 4: Keep Proof of Submission (Copy + Date)

Before you send your completed waiver questionnaire and documents, make copies of everything for your records. Note the date you submitted your request. If mailing, consider using certified mail with a return receipt so you have proof of delivery.

Step 5: Monitor Portal/Mail for Response

After you submit your waiver request, ADOL’s Waiver Committee will review your application and supporting documents. Processing times vary, but you should expect to wait several weeks to a few months for a decision. Check your Alabama Claimant Portal, email, and mail regularly for any requests for additional information or a final decision.

If You’re Also Appealing: Keep Filing Weekly Certifications

If you have filed an appeal and you are still unemployed and otherwise eligible for benefits, continue filing your weekly certifications while your appeal is pending. If your appeal is successful, you may be entitled to retroactive payment for those weeks. Failing to certify can result in a loss of benefits for those weeks, even if you win your appeal.

5. Alabama Waiver “Form”: Is There a Single Form?

Many people search for an “Alabama unemployment overpayment waiver form” expecting to find a universal PDF they can download, fill out, and submit. However, as of January 2026, Alabama does not publicly post a universal waiver form PDF that claimants can directly download from the ADOL website.

Instead, the waiver process is handled through a waiver questionnaire that you must request from ADOL. The questionnaire is provided to claimants on a case-by-case basis after they contact the Benefit Payment Control unit or the overpayments team.

How to get the questionnaire:

- Email UCOverpayments@labor.alabama.gov and request the waiver questionnaire.

- Call (334) 956-4000 or the Benefit Payment Control hotline at 1-800-392-8019 and ask to be sent the questionnaire.

- Visit or write to the Alabama Department of Labor, Benefit Payment Control, 649 Monroe Street, Room 3430, Montgomery, AL 36131-4200.

The questionnaire will be sent to you by mail or email (depending on ADOL’s current procedures). Once you receive it, complete it fully and return it with all required documentation.

6. Documents Checklist (What to Submit)

To strengthen your waiver request, you must provide documentation proving both that the overpayment was not your fault and that you face financial hardship. Here’s a comprehensive checklist of documents to gather and submit with your waiver questionnaire:

Income Proof

Provide evidence of your current income (and that of any household members, if relevant):

- Pay stubs (most recent 2–4 weeks or 1–2 months)

- Bank statements (recent 1–3 months)

- Self-employment income records (if applicable: 1099 forms, profit/loss statements)

- Other benefits received: SNAP, TANF, Social Security, SSI, disability, child support, etc. (award letters or statements)

- Unemployment benefit statements (if you are currently receiving benefits from Alabama or another state)

Necessary Expenses

Document your essential monthly expenses to demonstrate hardship:

- Rent or mortgage statement (lease agreement, mortgage statement, payment receipts)

- Utilities: Electric, gas, water, internet, phone (recent bills)

- Food expenses: Grocery receipts or a detailed monthly estimate

- Medical expenses: Insurance premiums, co-pays, prescriptions, medical bills

- Childcare or dependent care costs: Daycare invoices, babysitting costs

- Transportation: Car payment, insurance, gas, public transit costs

- Other essential expenses: Student loan payments, court-ordered support payments, etc.

Notices and Determinations

Include copies of relevant unemployment notices:

- Notice of Overpayment or Determination (the letter stating you owe an overpayment)

- Any appeal decisions (if you appealed and the decision is final)

- Correspondence with ADOL related to the overpayment

Additional Supporting Documents

Include any other documentation that supports your claim that the overpayment was not your fault or that repayment would cause hardship:

- Proof of job separation (layoff notice, termination letter) if relevant to the overpayment reason

- Medical records or disability documentation (if health issues contributed to the error or hardship)

- Written statements explaining the circumstances (e.g., why you didn’t understand you were ineligible, how the error occurred)

- Tax returns (if requested or relevant to prove income)

💡 Tip: Protect Your Sensitive Information

When submitting documents, do not email unencrypted files containing full Social Security Numbers, bank account numbers, or other highly sensitive data unless ADOL specifically instructs you to do so via a secure channel. If mailing, use certified mail. If faxing, confirm the correct fax number. Keep copies of everything you send.

7. What Happens After You Apply? (Timeline + Decision)

After you submit your completed waiver questionnaire and supporting documents to ADOL, the Waiver Committee will review your request. Here’s what to expect during the review process:

Processing Time (Varies)

There is no guaranteed timeline for waiver decisions. Processing times depend on the volume of waiver requests, the complexity of your case, and whether ADOL needs additional information. In general, expect the review to take several weeks to a few months. During busy periods (such as after mass overpayment notices), processing can take longer.

You can check on the status of your request by contacting ADOL via email at UCOverpayments@labor.alabama.gov or by phone at (334) 956-4000.

Possible Outcomes

ADOL’s Waiver Committee will issue a decision on your waiver request. The possible outcomes are:

- Full Waiver Approved: ADOL agrees to waive the entire overpayment. You will not be required to repay the debt, and collection efforts (such as offsets from future benefits or tax refunds) will stop.

- Partial Waiver Approved: ADOL agrees to waive part of the overpayment but requires you to repay a reduced amount. You will receive a notice explaining the approved waiver amount and the remaining balance owed.

- Waiver Denied: ADOL determines that you do not meet the criteria for a waiver (e.g., the overpayment was your fault, or you have the financial means to repay). You will be required to repay the full overpayment. You may have the right to appeal the waiver denial (see Section 8 below).

You will receive a written decision by mail or through your claimant portal. Read the decision carefully and follow any instructions provided.

If You Receive Requests for More Info—Respond Fast

During the review process, ADOL may contact you to request additional documentation or clarification. Respond to these requests promptly. Delays in providing requested information can slow down the review process or result in denial of your waiver request.

8. If Your Waiver Is Denied: Can You Appeal the Denial?

If ADOL denies your waiver request, you may have the right to appeal the waiver denial decision. The appeal process for waiver denials follows similar procedures to other unemployment appeals.

Steps to appeal a waiver denial:

- Read the denial notice carefully: The notice should explain why your waiver was denied and provide instructions for appealing the decision. It will also state the appeal deadline—typically 15 calendar days from the date the notice was mailed.

- Gather additional evidence: If your waiver was denied due to insufficient evidence of hardship or fault, collect additional documentation to support your case (updated financial statements, medical records, written explanations, etc.).

- File your appeal: Submit your appeal in writing to the ADOL Hearings and Appeals Division. You may be able to file online (you’ll need the Document ID from the denial notice), or by mail/fax.

- Prepare for your hearing: You will be scheduled for an appeal hearing (usually by phone). Be prepared to explain why you believe the waiver should be granted and present your evidence.

- Await the decision: An Administrative Law Judge (or hearing officer) will review your case and issue a decision. If the appeal is granted, your waiver may be approved. If denied, you may have further appeal rights to the Board of Appeals.

Important: Even if your waiver is denied, you may still be able to arrange a payment plan to repay the overpayment over time (see Section 9 below). Do not ignore the overpayment—collection actions can include wage garnishment, tax refund offsets, and other enforcement measures.

9. Repayment Options (If Pending or Denied)

If your waiver request is pending, denied, or you decide not to request a waiver, you will need to repay the overpayment. Alabama offers several repayment methods and options:

Payment Arrangements / Repayment System

If you cannot afford to repay the overpayment in full immediately, you can contact ADOL’s Benefit Payment Control unit to arrange a monthly payment plan. Payment arrangements allow you to repay the debt over time in manageable installments.

How to set up a payment plan:

- Phone: Call Benefit Payment Control at 1-800-392-8019 (8:00 a.m. – 5:00 p.m. CST, Monday–Friday) to discuss payment arrangements.

- Online: Visit Labor.Alabama.gov, select “Online Services,” then “Unemployment Services” to make payments online.

- Mail: Send payment by personal check, money order, or cashier’s check payable to Alabama Department of Labor. Mail to: Alabama Department of Labor, Attention: Benefit Payment Control, 649 Monroe Street, Montgomery, AL 36131. Do not send cash.

Automatic offsets: If you are currently receiving unemployment benefits from Alabama, each weekly benefit payment will be automatically offset (withheld) to repay the overpayment until the debt is paid in full. Offset amounts will appear on your Form 1099-G for tax purposes.

Note: Fraud overpayments cannot be repaid through automatic offsets. You must repay fraud overpayments (plus penalties and interest) in cash or via tax refund offset before you can receive future unemployment benefits.

Offsets & Collection Tools

If you do not repay your overpayment voluntarily or arrange a payment plan, ADOL has several collection tools available under Alabama law and administrative rules:

- State income tax refund offset: Alabama can intercept your state income tax refund to recover the overpayment debt. This is authorized under the Alabama Administrative Code and state setoff procedures.

- Federal income tax refund offset: Overpayments may also be withheld from your federal tax refund through the U.S. Treasury Offset Program (TOP).

- Wage garnishment: In some cases, ADOL can seek a court order to garnish your wages to recover the debt.

- Intercept of future unemployment benefits: If you file a new unemployment claim in Alabama (or in some cases, in another state through interstate agreements), your benefits may be offset to repay the prior overpayment.

- Referral to collections: Unpaid overpayments may be referred to a collection agency, which can negatively impact your credit and result in additional fees.

Best practice: If you owe an overpayment and cannot afford to repay it immediately, contact ADOL as soon as possible to set up a payment plan. This can help you avoid aggressive collection actions and demonstrate good faith.

10. Special Cases (Alabama)

Certain overpayment situations involve unique complications or require specialized handling. Here are some common special cases:

Identity Theft / Impostor Claims

If you received a notice of overpayment for unemployment benefits you never applied for or received—meaning someone filed a fraudulent claim using your identity—you should immediately report the fraud to ADOL and take steps to protect your identity.

What to do:

- Report the fraud to ADOL by email at TipHotline@labor.alabama.gov or by calling 1-855-234-2856.

- Complete any identity theft affidavits or fraud reporting forms ADOL provides.

- File a report with your local police department and obtain a police report number.

- Report the identity theft to the Federal Trade Commission (FTC) at IdentityTheft.gov.

- Monitor your credit reports and consider placing a fraud alert or credit freeze.

If ADOL determines the claim was fraudulent and you did not receive the benefits, you should not be held responsible for the overpayment. However, you must report the fraud and cooperate with ADOL’s investigation.

Wage-Reporting Issues

Some overpayments occur because your employer incorrectly reported (or failed to report) your wages to ADOL. If you believe the overpayment is due to employer error, gather documentation (pay stubs, W-2 forms, employer correspondence) and present this evidence when appealing the overpayment or requesting a waiver.

If your employer paid you “under the table” (cash, no tax withholding) or issued a 1099 instead of a W-2 when you should have been classified as an employee, report this to ADOL. Employers who misclassify workers or fail to report wages may be violating Alabama unemployment and tax laws.

Bankruptcy

Whether unemployment overpayments can be discharged in bankruptcy is a complex legal question that depends on the type of bankruptcy (Chapter 7, Chapter 13) and whether the overpayment is classified as fraud or non-fraud. In general:

- Non-fraud overpayments may be dischargeable in bankruptcy in some cases (consult a bankruptcy attorney).

- Fraud overpayments are typically not dischargeable under federal bankruptcy law because they involve debts obtained by fraud or false pretenses.

Disclaimer: Bankruptcy law is complex. If you are considering bankruptcy as an option for dealing with an unemployment overpayment, consult a qualified bankruptcy attorney licensed in Alabama. This guide does not provide legal advice on bankruptcy matters.

11. Frequently Asked Questions (FAQ)

▸ Does Alabama allow unemployment overpayment waivers?

Yes. Alabama allows claimants to request a waiver of overpayment under certain circumstances. You must complete a waiver questionnaire and provide documentation proving the overpayment was not your fault and that repaying it would cause financial hardship. Waivers are not available for fraud overpayments or appeal reversals.

▸ How do I get the waiver questionnaire?

Contact ADOL by email at UCOverpayments@labor.alabama.gov or call (334) 956-4000 or 1-800-392-8019 to request the waiver questionnaire. The questionnaire is not publicly available for download; you must request it from ADOL.

▸ Is a waiver available for fraud overpayments?

Generally, no. Alabama’s official guidance states that “overpayments determined to result from fraudulent intent or appeal reversals will not be waived.” If your overpayment is classified as fraud, you are typically not eligible for a waiver and must repay the debt plus penalties and interest.

▸ Can I appeal and request a waiver at the same time?

Yes, but waiver reviews typically occur after all appeal rights have been exhausted or become final. If you disagree with the overpayment, file an appeal first to contest the determination. If the appeal is unsuccessful and the overpayment becomes final, you can then request a waiver.

▸ Do I need my Document ID to appeal?

Usually, yes for online filing. If you submit an appeal through ADOL’s online system, you’ll typically need the Document ID shown on your Notice of Determination/Overpayment. If you don’t have the Document ID yet, check your portal and mail for the notice, or contact ADOL. In many cases, you may still be able to file an appeal by mail or fax using your identifying claim information and the details of the determination.

▸ Should I keep filing weekly certifications during an appeal?

Yes. If you file an appeal and you’re still unemployed and otherwise eligible, continue filing your weekly certifications while the appeal is pending. If your appeal is successful, you may be entitled to retroactive benefits for those weeks. Failing to certify can result in loss of benefits even if you win.

▸ Will they offset my tax refund?

Yes. Alabama can offset both state and federal income tax refunds to recover unemployment overpayments. If you owe an overpayment and do not repay it voluntarily, ADOL may intercept your tax refund to satisfy the debt.

▸ What documents prove hardship?

Documents that prove financial hardship include: recent pay stubs or proof of income (or unemployment), bank statements, rent/mortgage statements, utility bills, medical bills, childcare costs, and documentation of other essential monthly expenses. The goal is to show that your income is insufficient to cover basic needs and repay the overpayment.

▸ How long does the waiver review take?

Waiver review times vary depending on case volume and complexity. Expect the process to take several weeks to a few months. If ADOL requests additional information, respond promptly to avoid further delays. You can check on the status by contacting ADOL at UCOverpayments@labor.alabama.gov or (334) 956-4000.

▸ What if I already repaid part of the overpayment?

If you’ve already made partial payments toward the overpayment before requesting a waiver, those payments will not automatically be refunded even if the waiver is approved. However, if a full or partial waiver is granted, you will not be required to repay the waived amount. Always document your payments and keep receipts.

▸ How do I contact Alabama unemployment overpayment support?

Contact ADOL’s overpayment team by email at UCOverpayments@labor.alabama.gov or call Benefit Payment Control at 1-800-392-8019 (8:00 a.m. – 5:00 p.m. CST, Monday–Friday). You can also call the main ADOL number at (334) 956-4000.

▸ Where do I repay an overpayment?

You can repay your overpayment online at Labor.Alabama.gov (select “Online Services,” then “Unemployment Services”), by phone at 1-800-392-8019 to set up a payment plan, or by mail (personal check, money order, or cashier’s check payable to Alabama Department of Labor, mailed to: Alabama Department of Labor, Attention: Benefit Payment Control, 649 Monroe Street, Montgomery, AL 36131). Do not send cash.

12. Official Resources (Sources + Next Steps)

Use these official Alabama Department of Labor and government resources for the most accurate and up-to-date information about overpayment waivers, appeals, and repayment:

Alabama Department of Labor (ADOL) Resources

- ADOL Hearings and Appeals Division: File an appeal, check appeal status, and find information about the appeal process.

- ADOL Miscellaneous Information FAQ (PDF): Official FAQ covering overpayments, waivers, fraud, repayment, and more.

- ADOL Overpayment FAQ: Contact information and answers to common overpayment questions.

- Alabama Claimant Portal: Log in to check your claim status, overpayment balance, and messages from ADOL.

- Alabama Unemployment Compensation Benefit Rights and Responsibilities Handbook (PDF): Comprehensive guide to Alabama unemployment benefits, eligibility, and overpayments.

- ADOL Claimants Page: General information for unemployment claimants, including how to file claims and appeals.

Alabama Administrative Code

- Alabama Administrative Code Rule 480-4-4-.07 — Waiver of Requirement to Repay Overpayments: Official rule governing waiver eligibility and procedures.

- Alabama Administrative Code Rule 480-4-4-.03 — Determination and Collection of Overpayments: Rule covering how overpayments are determined and collected.

Contact Information

- Overpayment Questions: Email UCOverpayments@labor.alabama.gov or call (334) 956-4000

- Benefit Payment Control (Repayment): 1-800-392-8019 (8:00 a.m. – 5:00 p.m. CST, Monday–Friday)

- Fraud Hotline: Email TipHotline@labor.alabama.gov or call 1-855-234-2856

- Claims Assistance: 1-866-234-5382 (7:00 a.m. – 5:00 p.m. CST, Monday–Friday)

Related Guides (Internal Links)

- Alabama Unemployment Guide (Hub) — Complete guide to Alabama unemployment benefits

- Unemployment Overpayment Waiver Guide (All States) — General guide to overpayment waivers nationwide

- How to Appeal a Denied Unemployment Claim — Step-by-step appeal guide

Next Steps

- Review your overpayment notice carefully. Identify the reason, amount, deadline, and whether it’s classified as fraud or non-fraud.

- Decide your strategy: If the overpayment is wrong, file an appeal immediately. If it’s correct but you can’t pay, request a waiver questionnaire or set up a payment plan.

- Gather documentation: Collect proof of income, expenses, and any evidence supporting your claim that the overpayment was not your fault.

- Submit your waiver request or appeal before the deadline. Keep copies of everything you send.

- Stay in communication with ADOL. Respond promptly to requests for information and monitor your portal/mail for updates.

🔑 Final Takeaways

If you owe an Alabama unemployment overpayment, you have options. A waiver can forgive the debt if the overpayment was not your fault and repaying it would cause hardship—but you must request it in writing by completing a waiver questionnaire from ADOL. Waivers are generally not available for fraud overpayments or appeal reversals.

If you disagree with the overpayment, file an appeal within the deadline—in Alabama, that is within seven calendar days after delivery of the notice or within 15 calendar days after the notice was mailed to your last known address (whichever applies).

For help, contact ADOL at UCOverpayments@labor.alabama.gov or call (334) 956-4000. Always keep copies of all documents and communications.

⚠️ Legal Disclaimer

This guide is for informational purposes only and does not constitute legal, financial, or professional advice. Unemployment overpayment rules, waiver eligibility, and procedures can be complex and vary by individual circumstance. Always verify information with the Alabama Department of Labor or consult a qualified legal professional for advice specific to your situation.

📚 Sources

- Alabama Department of Labor, Miscellaneous Information (Overpayments, Fraud, Waivers). https://labor.alabama.gov/uc/MiscellaneousInformation.pdf

- Alabama Administrative Code, Rule 480-4-4-.07 — Waiver of Requirement to Repay Overpayments. https://admincode.legislature.state.al.us/administrative-code/480-4-4-.07

- Alabama Department of Labor, Hearings and Appeals Division. https://adol.alabama.gov/divisions/unemployment-compensation/hearings-and-appeals/

- Alabama Department of Labor, What if I have questions about an unemployment compensation overpayment? https://adol.alabama.gov/faq/what-if-i-have-questions-about-an-unemployment-compensation-overpayment/

- Alabama Workforce, Alabama Unemployment Compensation Benefit Rights and Responsibilities. https://workforce.alabama.gov/documents/benefit-rights-and-responsibilities/

- Alabama Legal Help, Requesting a Waiver of Overpayment. https://www.alabamalegalhelp.org/resource/requesting-a-waiver-of-overpayment

Need More Help with Alabama Unemployment?

Explore our complete Alabama unemployment guide, learn how to appeal a denial, check your claim status, and find answers to common questions.