How to Request a Non-Fraud Unemployment Overpayment Waiver in Georgia, Including the DOL-5A Form, 15-Day Deadline, Required Documents, and What to Do If Denied

⏰ Critical Deadline

You must submit the waiver application (DOL-5A) within 15 days of the overpayment determination mail date. This deadline is strictly enforced. If you miss it, your waiver request will be denied, and you will have to repay the full amount (unless you qualify for the special pandemic-era redetermination exception).

⚡ TL;DR — Appeal or Waiver?

If you disagree with the overpayment (you believe you were entitled to those benefits) → File an appeal within 15 days.

If you accept the overpayment happened but it wasn’t your fault and repaying would cause financial hardship → Request a waiver using Form DOL-5A within 15 days.

📌 Key Takeaways

- Waiver = forgiveness of debt: If approved, you do not have to repay the overpayment (but money already repaid is usually not refunded).

- Two requirements: (1) The overpayment was not your fault, and (2) repaying would be contrary to equity and good conscience (financial hardship).

- 15-day deadline: You must submit Form DOL-5A within 15 days of the overpayment determination mail date.

- Non-fraud only: Waivers are generally limited to non-fraud overpayments. If GDOL classified your overpayment as fraud, you will typically need to appeal the fraud/overpayment determination.

If you received a Notice of Determination and Overpayment from the Georgia Department of Labor (GDOL) stating that you were paid unemployment benefits you were not entitled to receive, you may be facing a demand to repay hundreds or even thousands of dollars. This can be overwhelming, especially if you relied on those benefits to cover basic living expenses and did not intentionally commit fraud.

Fortunately, Georgia law allows eligible claimants to request a non-fraud overpayment waiver, which forgives the debt if you meet two key conditions: the overpayment was not your fault, and repaying it would cause financial hardship. This guide will walk you through everything you need to know about the Georgia unemployment overpayment waiver process, including how to complete and submit Form DOL-5A, what documents to include, the strict 15-day deadline, and what to do if your waiver is denied.

⚠️ Disclaimer: This guide is for informational purposes only and does not constitute legal advice. Unemployment overpayment rules can be complex and vary by individual circumstances. Always verify information with GDOL or consult a qualified attorney if you need legal assistance.

📑 Table of Contents

- What Is an Overpayment Waiver in Georgia?

- Appeal vs Waiver — Which One Should You File?

- Georgia Waiver Requirements (Non-Fraud)

- Deadline (Critical) — 15 Days

- How to Apply (Step-by-Step)

- What Documents Help Most (Supporting Evidence)

- What Happens After You Submit?

- If Your Waiver Is Denied — Redetermination or Appeal

- Repayment Options If You Don’t Appeal

- Common Scenarios (Mini-Cases)

- Mistakes That Get Waivers Denied

- Frequently Asked Questions (FAQ)

- Official Resources & Next Steps

1. What Is an Overpayment Waiver in Georgia?

An overpayment waiver is a formal request to the Georgia Department of Labor (GDOL) to forgive (waive) the repayment of unemployment benefits that were overpaid to you. If your waiver is approved, you will not be required to repay the overpayment amount, and GDOL may stop or avoid collection actions allowed by law.

Waivers are generally limited to non-fraud overpayments. This means the overpayment was established for reasons other than intentional fraud, misrepresentation, or withholding of information. Common causes of non-fraud overpayments include administrative errors, misreported earnings, appeal reversals, failure to report disqualifying income (such as vacation or severance pay), or being paid under an incorrect federal pandemic program.

What Does “Contrary to Equity and Good Conscience” Mean?

Georgia law requires that recovery of the overpayment must be “contrary to equity and good conscience” for a waiver to be approved. In plain language, this means that requiring you to repay the money would be unfair given your current financial situation. GDOL looks at factors such as:

- Whether repayment would cause you to lose access to minimal necessities (food, medicine, shelter) for a substantial period of time.

- Whether you have little or no reasonable prospect of future employment or income due to age, disability, or other good cause.

- Whether you have already exhausted savings, sold assets, or incurred debt to meet basic living expenses.

In short, GDOL will evaluate whether forcing you to repay the overpayment would put you in severe financial distress.

2. Appeal vs Waiver — Which One Should You File?

Many claimants are confused about the difference between an appeal and a waiver. The choice depends on whether you believe the overpayment determination is correct.

File an Appeal When…

- You disagree with the overpayment determination: You believe you were entitled to receive unemployment benefits for the weeks in question.

- The overpayment amount is incorrect: GDOL miscalculated the amount of benefits you received or should have received.

- You believe you met all eligibility requirements: For example, you were able and available for work, you reported earnings correctly, or you had a qualifying job separation.

- Your employer or GDOL made an error: For example, your employer incorrectly reported that you quit (when you were actually laid off), or GDOL failed to properly process documentation you submitted.

Bottom line: If you think the overpayment should not exist at all, file an appeal. If you win your appeal, the overpayment will be removed, and you will not owe anything.

Request a Waiver When…

- You accept that the overpayment occurred: You agree that you were paid benefits you were not entitled to receive.

- The overpayment was not your fault: You made an honest mistake, GDOL made an administrative error, or circumstances beyond your control caused the overpayment.

- Repaying the money would cause financial hardship: You cannot afford to repay the overpayment without losing access to basic necessities (food, housing, medical care).

- You have little or no prospect of repaying the debt: Due to age, disability, lack of employment, or other reasons, you do not expect to be able to repay the overpayment in the foreseeable future.

Bottom line: If the overpayment is correct but it wasn’t your fault and you can’t afford to pay it back, request a waiver.

💡 Pro Tip

Some claimants choose to file an appeal and also submit a waiver request if they’re unsure which route to take. If you do, make sure you meet the 15-day deadline for both. If your appeal is successful, the waiver request becomes unnecessary.

3. Georgia Waiver Requirements (Non-Fraud)

To qualify for a non-fraud overpayment waiver in Georgia, you must meet two core requirements:

The 2 Core Requirements

- You were not at fault for the overpayment: The overpayment was caused by an administrative error, employer misreporting, confusion about program rules, or other reasons beyond your control. You did not intentionally misrepresent information or commit fraud.

- Repayment would be contrary to equity and good conscience: Requiring you to repay the overpayment would be unfair given your current financial situation. You would lose access to minimal necessities (food, medicine, shelter) or have no reasonable prospect of repaying the debt.

Both requirements must be met. If GDOL determines that you were at fault (for example, you failed to report earnings you knew about), or if GDOL determines that you can afford to repay the overpayment without hardship, your waiver will be denied.

What GDOL Looks For (Evidence & Proof)

GDOL reviews waiver applications case-by-case. According to official GDOL guidance, they may approve a waiver when the following conditions exist:

- The waiver application was submitted within 15 days of the overpayment determination mail date.

- The overpayment was not established due to fraud (waiver rights are provided only on non-fraud overpayment determinations).

- Benefits were paid based on no fault of the claimant: The claimant did not intentionally provide false information or fail to disclose required information.

- The claimant shows proof that repayment would cause financial hardship: This includes documentation of income, expenses, debts, and assets.

- Recovery would result in loss of minimal necessities: The claimant would be unable to afford food, medicine, or shelter for a substantial period of time and in the foreseeable future.

- The claimant has no reasonable prospect of future employment or ability to repay due to age, disability, or other good cause.

Your supporting documents (discussed in Section 6 below) should directly address these factors.

4. Deadline (Critical) — 15 Days

The single most important thing to understand about the Georgia unemployment overpayment waiver is the 15-day deadline. According to Georgia law and GDOL policy, your waiver application must be submitted within 15 calendar days of the overpayment determination mail date.

The mail date is the date printed on your Notice of Determination and Overpayment. It is not the date you received the notice in the mail. GDOL assumes you received the notice within a few days of the mail date, so the clock starts ticking immediately.

What Happens If You Miss the Deadline?

If you submit your waiver application after the 15-day deadline, GDOL will deny your waiver request based solely on the late filing, regardless of whether you meet the other eligibility requirements. This is one of the most common reasons waivers are denied.

Exception: Pandemic-Era Overpayments (February 2020 – June 2021)

There is one exception to the 15-day rule: If your overpayment was established for claim weeks ending between February 8, 2020, and June 26, 2021, the 15-day time limitation may be waived. This exception was created to address processing delays and confusion during the COVID-19 pandemic.

If you previously applied for a waiver and were denied prior to April 15, 2022, for failure to file a timely application, you may request a redetermination of your denied waiver. Only overpayments for claim weeks ending February 8, 2020, through June 26, 2021, are eligible for redetermination.

⚠️ Do Not Wait

Do not wait until day 14 to start preparing your waiver application. Gather your documents, complete the DOL-5A form, and submit it as soon as possible after receiving the overpayment notice. If you miss the 15-day deadline and your overpayment is not from the pandemic period, you will lose your chance to request a waiver.

5. How to Apply (Step-by-Step)

Follow these five steps to request a non-fraud overpayment waiver in Georgia:

Step 1 — Get the Official Form (DOL-5A)

Download the Application for Overpayment Waiver (Form DOL-5A) from the GDOL website:

If you need the form in a language other than English, email Overpaymentwaiver@gdol.ga.gov or visit your local GDOL career center to ask about language assistance options.

Step 2 — Fill It Out Correctly

Complete every section of Form DOL-5A. Make sure to include:

- Your full name (as it appears on your Social Security card)

- Social Security Number

- Mailing address and phone number

- Claim ID or file number (if listed on your overpayment notice)

- Overpayment amount and weeks affected (as shown on your Notice of Determination and Overpayment)

- Explanation of why you were not at fault for the overpayment

- Explanation of why repayment would cause financial hardship (be specific: list monthly income, expenses, debts, and explain how repayment would affect your ability to afford necessities)

- Your signature and date

💡 Pro Tip

Be as detailed and specific as possible when explaining your financial situation. Instead of saying “I can’t afford to pay,” write something like: “I currently receive $800/month in unemployment benefits and have $1,200 in monthly expenses (rent $750, utilities $150, food $200, medication $100). I have no savings and no other income. Repaying $3,000 would require me to skip rent payments and go without food and medication.”

Step 3 — Attach Supporting Documents

Your waiver application will be stronger if you attach supporting documents that prove financial hardship and that the overpayment was not your fault. See Section 6 below for a detailed list of recommended documents.

Step 4 — Submit (Email or Mail)

You can submit your completed waiver application and supporting documents by email or mail:

- Email: Overpaymentwaiver@gdol.ga.gov

(Attach the completed DOL-5A form and all supporting documents as PDFs or images. Use a clear subject line like “Waiver Request — [Your Name] — [SSN Last 4 Digits]”.) - Mail:

Georgia Department of Labor

Attn: Overpayment Unit – Waiver Request

P.O. Box 3433

Atlanta, GA 30302

💡 Pro Tip

Email is faster and more reliable. If you mail your waiver, use certified mail with tracking so you have proof it was sent and delivered. Submit as early as possible to avoid any deadline disputes.

Step 5 — Keep Proof

Save copies of everything you submit. If you email your waiver, take a screenshot of the sent email confirmation. If you mail it, keep the certified mail receipt and tracking number. This proof may be critical if there is any dispute about whether you met the 15-day deadline.

6. What Documents Help Most (Supporting Evidence)

The more evidence you provide, the stronger your waiver application will be. GDOL wants to see proof that (1) you were not at fault for the overpayment, and (2) repaying it would cause financial hardship.

Financial Hardship (Core Evidence)

To prove financial hardship, include documents that show your current income, expenses, debts, and assets:

- Rent or mortgage statements: Show how much you pay each month for housing.

- Utility bills: Electric, gas, water, internet, phone.

- Bank statements (summary): Show your account balance and recent transactions (you can redact sensitive information, but show enough to prove you have little or no savings).

- Pay stubs or proof of current income: If you’re working, show your current earnings. If you’re unemployed, include a statement explaining that you have no income or only unemployment benefits.

- Medical bills or prescription receipts: Especially important if you have ongoing medical expenses.

- Credit card statements or debt collection notices: Show existing debts and monthly payments.

- Food assistance or other public benefits: If you receive SNAP, TANF, Medicaid, or other assistance, include proof (this shows you already rely on safety-net programs and have limited resources).

- Letter from a social worker, case manager, or nonprofit organization: If you’re receiving help from a community organization, ask them to write a brief letter confirming your financial situation.

“Not at Fault” Evidence

To prove you were not at fault, include documents that explain why the overpayment happened and show it was beyond your control:

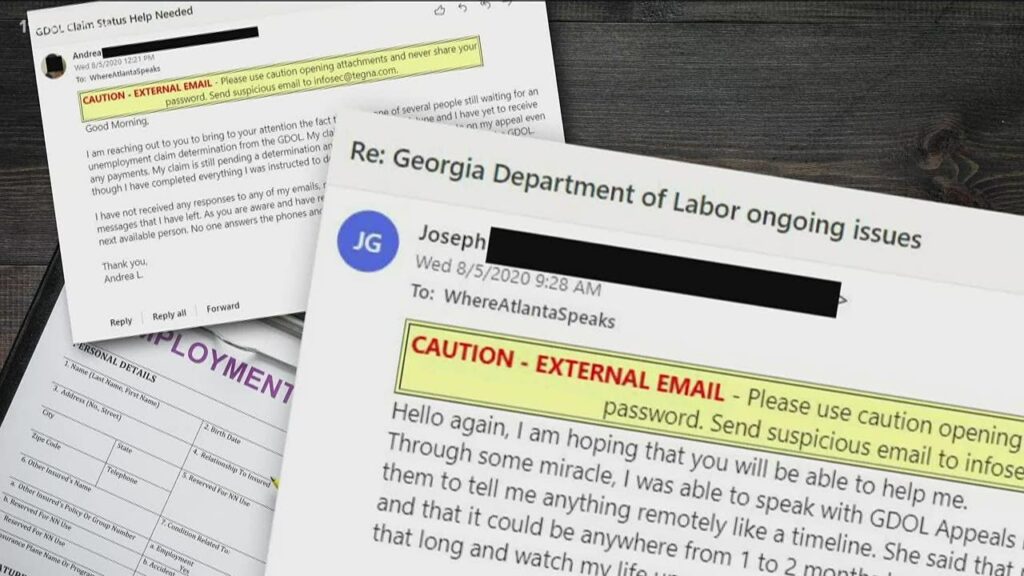

- Copies of communications with GDOL: Emails, letters, or screenshots of your online account showing you reported information correctly or asked for clarification.

- Employer documentation: If your employer misreported wages or your separation reason, include a corrected letter or statement from your employer (if available).

- Identity verification issues: If the overpayment was caused by ID.me or identity verification delays, include documentation showing you attempted to verify your identity promptly.

- Pandemic program confusion: If you were paid under an incorrect federal pandemic program (e.g., PUA instead of PEUC), include a statement explaining that you followed GDOL’s instructions or that you did not know you were in the wrong program.

- Appeal or redetermination history: If the overpayment was established after an appeal or redetermination reversed an earlier decision, include copies of those decisions to show you were originally approved and relied on those benefits.

💡 Pro Tip

Do not wait to gather “perfect” documentation. If you’re approaching the 15-day deadline and don’t have every document on this list, submit what you have. You can always follow up with additional documents later. Missing the deadline is worse than submitting an incomplete application.

7. What Happens After You Submit?

After you submit your waiver application, GDOL will review your request and supporting documents. This process can take several weeks or even months, depending on GDOL’s workload.

You Will Receive a Written Decision

GDOL will send you a written notice by mail (and possibly by email or through your online account) informing you whether your waiver was approved or denied.

- If your waiver is approved: You are no longer required to repay the overpayment. GDOL may stop collection activity, and the debt will be forgiven. However, any money you already repaid (before the waiver was approved) will not be refunded to you unless required under federal regulations.

- If your waiver is denied: You must repay the overpayment in full or make monthly payments. You also have the right to appeal the denial (see Section 8 below).

What About Money Already Repaid?

According to GDOL policy, if your waiver is approved, money you already repaid will generally not be refunded unless federal regulations require it. This means if you paid $500 toward a $2,000 overpayment before your waiver was approved, you will not get that $500 back. The remaining $1,500 will be waived.

There are limited exceptions under federal law for certain pandemic-era overpayments. If you believe you are entitled to a refund, contact GDOL or consult an attorney.

8. If Your Waiver Is Denied — Redetermination or Appeal

If GDOL denies your waiver request, you have two options: request a redetermination (if eligible) or file an appeal.

Request a Redetermination (Pandemic-Era Overpayments Only)

If your waiver was denied and your overpayment was for claim weeks ending between February 8, 2020, and June 26, 2021, you may be eligible to request a redetermination of your denied waiver. This is a special option created to address processing delays and confusion during the pandemic.

To request redetermination, email Overpaymentwaiver@gdol.ga.gov or mail your request to:

Georgia Department of Labor

Attn: Overpayment Unit – Waiver Request

P.O. Box 3433

Atlanta, GA 30302

File an Appeal (All Other Cases)

If you do not qualify for redetermination (or if your redetermination is also denied), you can file an appeal of the waiver denial. Your appeal must be filed within 15 calendar days of the mail date of the waiver denial notice.

You can file an appeal online, by email, or by mail:

- Online: File an Appeal (GDOL Portal)

- Email: dol.appeals@gdol.ga.gov

- Mail:

Georgia Department of Labor

Attn: UI Appeals Tribunal

148 Andrew Young International Blvd., NE

Suite 525

Atlanta, GA 30303-1734

Continue Certifying While Your Appeal Is Pending

If you are still unemployed and eligible for unemployment benefits, continue to certify for benefits each week while your appeal is pending. If you win your appeal, GDOL will only pay benefits for weeks you certified. If you stop certifying and later win your appeal, you will not receive retroactive benefits for those uncertified weeks.

✅ Checklist: Appeal a Waiver Denial

- Read your waiver denial notice carefully. Note the mail date and calculate your appeal deadline.

- File your appeal within 15 days (online, email, or mail).

- Include a written statement explaining why you believe the waiver should have been granted.

- Attach any additional documents or evidence you did not include with your original waiver application.

- Continue certifying for benefits each week (if you are still eligible).

9. Repayment Options If You Don’t Appeal (or While You Decide)

If you do not file an appeal (or if you decide to repay the overpayment while your appeal is pending), you must begin making payments. GDOL may bill you monthly if you do not repay the full amount immediately.

How to Make a Payment

You can pay your overpayment online or by mail:

- Pay online: Repayment of Overpaid Benefits (GDOL Portal)

(You can set up a one-time payment or automatic monthly payments via bank account debit.) - Pay by mail:

Make your check or money order payable to Georgia Department of Labor and mail to:

Georgia Department of Labor

Attn: Overpayment Unit

P.O. Box 3433

Atlanta, GA 30302

(Include your Social Security number and claim number on your payment.)

Monthly Payment Plans

If you cannot repay your overpayment in full, GDOL may bill you monthly for a minimum payment amount. The minimum monthly payment is determined by the size of your overpayment and the allowable repayment period under Georgia law.

If you are having trouble making payments, contact the GDOL Overpayment Unit immediately to discuss your situation. Do not ignore the bills—failure to repay can lead to collection activity allowed by law.

10. Common Scenarios (Mini-Cases)

Here are real-world scenarios that often result in overpayments and how waivers may apply:

Scenario 1: Overpayment Due to Employer Reporting Issue

Situation: Your employer initially reported you were laid off. GDOL approved your benefits. Months later, your employer corrected their report to say you were terminated for misconduct. GDOL reversed the decision and established an overpayment.

What to do: If you believe the termination was not for misconduct, file an appeal of the overpayment determination. If the termination was for misconduct but you relied on your employer’s original report and GDOL’s initial approval in good faith, you may request a waiver (argue you were not at fault and repayment would be unfair).

Scenario 2: Identity Verification / ID.me Delay

Situation: GDOL paid you benefits for several weeks while your identity verification was pending. Later, GDOL determined you were not eligible during that time because you had not completed identity verification, and they established an overpayment.

What to do: Request a waiver. Argue that you submitted your identity verification documents promptly and that the delay was not your fault. Include proof that you attempted to verify your identity (emails, screenshots, ID.me receipts).

Scenario 3: Pandemic Program Mismatch (Paid Under Incorrect Program)

Situation: You were paid under PUA (Pandemic Unemployment Assistance) but GDOL later determined you should have been paid under regular UI or PEUC at a lower weekly benefit amount. The difference is considered an overpayment.

What to do: Request a waiver. Argue that you followed GDOL’s instructions, that you did not know you were in the wrong program, and that the overpayment was GDOL’s error, not yours. Include any correspondence showing you relied on GDOL’s guidance.

Scenario 4: You Reported Wages But the System Didn’t Reflect It

Situation: You reported part-time earnings each week when certifying for benefits, but GDOL’s system failed to adjust your weekly benefit amount. Later, GDOL audited your claim and established an overpayment for the difference.

What to do: Request a waiver. Argue that you reported earnings accurately and in good faith, and that the system error was not your fault. Include screenshots or copies of your weekly certifications showing you reported wages.

Scenario 5: You Truly Weren’t Eligible (Able/Available Issue)

Situation: GDOL determined that you were not “able and available” for work during certain weeks (for example, you were hospitalized or caring for a family member). An overpayment was established for those weeks.

What to do: This is a harder case for a waiver because you may have been genuinely ineligible. However, if you believed in good faith that you were eligible (for example, you thought you could accept work from home or part-time), you can still request a waiver. Explain why you thought you were eligible and argue that the overpayment was an honest misunderstanding, not intentional fraud. Be prepared for the possibility that your waiver will be denied, and consider whether you should appeal the underlying eligibility determination instead.

11. Mistakes That Get Waivers Denied

Here are the most common mistakes that result in waiver denials:

- Missing the 15-day deadline: This is the #1 reason waivers are denied. Do not wait until the last day to submit your application.

- Not providing financial hardship documentation: If you don’t attach proof of income, expenses, and financial hardship, GDOL has no basis to approve your waiver.

- Confusing appeal with waiver: If you believe the overpayment is incorrect, file an appeal, not a waiver. A waiver is only for cases where you accept the overpayment but believe repayment would be unfair.

- Fraud overpayments: Waivers are generally limited to non-fraud overpayments. If your overpayment is classified as fraud, you will typically need to appeal the fraud/overpayment determination.

- Not explaining “not at fault”: You must clearly explain why the overpayment was not your fault. If you don’t provide a convincing explanation, GDOL may assume you were at fault and deny your waiver.

12. Frequently Asked Questions (FAQ)

▸ What is the deadline for a Georgia overpayment waiver?

You must submit the waiver application (Form DOL-5A) within 15 calendar days of the overpayment determination mail date. This deadline is strictly enforced.

▸ Where do I email the waiver application (DOL-5A)?

Email your completed DOL-5A form and supporting documents to Overpaymentwaiver@gdol.ga.gov. You can also mail it to: Georgia Department of Labor, Attn: Overpayment Unit – Waiver Request, P.O. Box 3433, Atlanta, GA 30302.

▸ Can I appeal if my waiver is denied? What’s the deadline?

Yes. If your waiver is denied, you can file an appeal within 15 calendar days of the mail date of the waiver denial notice. You can file online at dol.georgia.gov/file-appeal, by email to dol.appeals@gdol.ga.gov, or by mail.

▸ Should I appeal or request a waiver?

Appeal if you disagree with the overpayment (you believe you were entitled to those benefits). Request a waiver if you accept the overpayment happened but it wasn’t your fault and repaying would cause financial hardship.

▸ Do I need to keep certifying while my appeal is pending?

Yes. If you are still eligible for unemployment benefits, continue certifying each week while your appeal is pending. If you win your appeal, GDOL will only pay benefits for weeks you certified.

▸ How do I pay back an overpayment online in Georgia?

Visit the Repayment of Overpaid Benefits portal to make a one-time payment or set up automatic monthly payments.

▸ What documents help prove financial hardship?

Rent/mortgage statements, utility bills, bank statements, pay stubs (or proof of no income), medical bills, debt statements, and proof of public assistance (SNAP, Medicaid, etc.).

▸ Will GDOL refund money I already repaid if I get a waiver?

Generally, no. GDOL states that money already repaid will not be refunded unless required under federal regulations. There are limited exceptions for certain pandemic-era overpayments.

▸ Can I get a waiver for a fraud overpayment?

Waivers are generally limited to non-fraud overpayments. If your overpayment is classified as fraud, you will typically need to appeal the fraud/overpayment determination.

▸ What if I missed the 15-day deadline?

If you missed the deadline and your overpayment is for claim weeks ending between February 8, 2020, and June 26, 2021, you may request a redetermination. For all other overpayments, missing the 15-day deadline generally means you cannot request a waiver and must repay the overpayment or appeal the underlying overpayment determination.

13. Official Resources & Next Steps

Here are the most important official resources for Georgia unemployment overpayment waivers:

Official GDOL Resources

- GDOL Overpayment & Waiver Request Information: Official page with waiver eligibility details, instructions, and contact information.

- Application for Overpayment Waiver (Form DOL-5A): The official waiver form (PDF).

- GDOL Individuals FAQs (Appeal + Waiver Denial Appeal): Frequently asked questions about appeals, waivers, and redeterminations.

- Repayment of Overpaid Benefits Portal: Pay your overpayment online or set up a payment plan.

- File an Appeal (GDOL Portal): Online appeal filing for overpayment determinations or waiver denials.

Contact Information

- Waiver requests (email): Overpaymentwaiver@gdol.ga.gov

- Waiver requests (mail):

Georgia Department of Labor

Attn: Overpayment Unit – Waiver Request

P.O. Box 3433

Atlanta, GA 30302 - Appeals (email): dol.appeals@gdol.ga.gov

Related Guides on TheUnemployment.org

- Georgia Unemployment Benefits Guide (Complete)

- How to Appeal a Denied Unemployment Claim

- Unemployment Overpayment Guide (All States)

Next Steps

- Act immediately: Check the mail date on your overpayment notice and calculate your 15-day deadline.

- Download Form DOL-5A: Get the form here.

- Gather your documents: Collect proof of financial hardship and evidence that you were not at fault.

- Submit by email (recommended): Send to Overpaymentwaiver@gdol.ga.gov within 15 days.

- Save proof of submission: Keep a copy of your email confirmation or mailing receipt.

🔑 Final Takeaways

If you received a Georgia unemployment overpayment notice, you have 15 days from the mail date to request a waiver using Form DOL-5A. To qualify, you must show that (1) the overpayment was not your fault, and (2) repaying would cause financial hardship. Attach as much supporting documentation as possible (bank statements, bills, proof of income, etc.).

If you disagree with the overpayment itself, file an appeal instead of (or in addition to) a waiver request. If your waiver is denied, you can appeal the denial within 15 days.

Do not miss the 15-day deadline. Email is faster and more reliable than mail. Keep proof of submission. If you need help, contact GDOL immediately or consult an attorney.

⚠️ Legal Disclaimer

This guide is for informational purposes only and does not constitute legal, financial, or professional advice. Unemployment overpayment rules vary by individual circumstances and can be complex. Always verify information with the Georgia Department of Labor or consult a qualified attorney for advice specific to your situation.

📚 Sources

- Georgia Department of Labor, Overpayment and Waiver Request Information. https://dol.georgia.gov/overpayment-and-waiver-request-information

- Georgia Department of Labor, Application for Overpayment Waiver (Form DOL-5A). https://dol.georgia.gov/document/unemployment-benefits/application-overpayment-waiver-dol-5a/download

- Georgia Department of Labor, Individuals FAQs — Unemployment Insurance. https://dol.georgia.gov/faqs-individuals/individuals-faqs-unemployment-insurance

- Georgia Department of Labor, Repayment of Overpaid Benefits Portal. https://www.dol.state.ga.us/public/uiben/opach/enroll

- Georgia Administrative Code, Rule 300-2-4-.08 — Overpayments. https://rules.sos.ga.gov/gac/300-2-4

- Georgia Department of Labor, UI Claimant Handbook. https://dol.georgia.gov/document/unemployment-benefits/ui-claimant-handbook/download

Need Help with Your Georgia Unemployment Claim?

Explore our state-by-state guides, learn how to appeal a denial, and find answers to your most common unemployment questions.